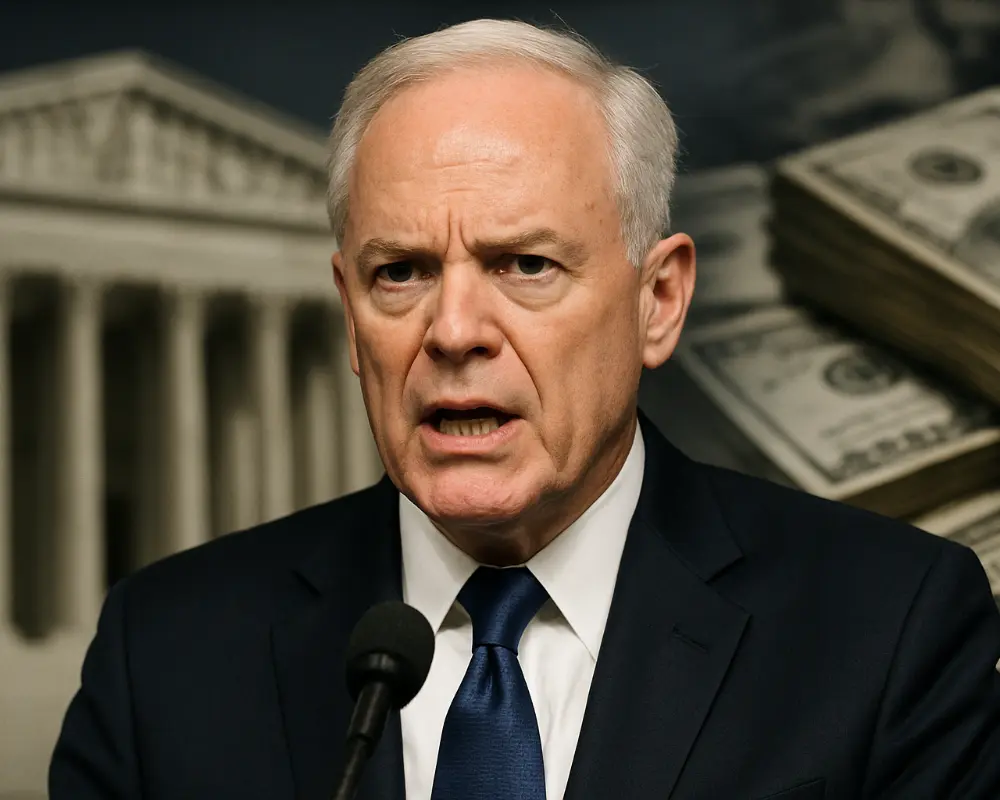

Treasury Sec. Scott Bessent issues a U.S. tariff refund warning as SCOTUS reviews Trump-era tariffs, raising risks for the economy and global trade.

Brajesh Mishra

Brajesh Mishra

Treasury Secretary Scott Bessent raised alarms on September 7, 2025, when he told NBC’s Meet the Press that the U.S. might have to refund a large share of Trump-era tariffs if the Supreme Court rules them unlawful. His words were blunt: “We would have to give a refund on about half the tariffs, which would be terrible for the Treasury.”

The statement highlights the stakes of the ongoing legal battle. A Supreme Court ruling could create a hole worth hundreds of billions of dollars in U.S. finances. The outcome would also shape global trade flows and test how far a president can stretch emergency powers under the International Emergency Economic Powers Act (IEEPA).

The dispute traces back to Trump’s second-term tariff program. He used the IEEPA to impose wide-ranging duties on imports from China, Mexico, Canada, and other partners, branding them “reciprocal tariffs.”

On August 29, 2025, the Federal Circuit Court of Appeals ruled 7-4 that these tariffs went beyond presidential authority. Judges stressed that tariff policy is Congress’s job, not the president’s, and that the IEEPA does not grant open-ended power to set trade taxes. They invoked the major questions doctrine, which says Congress must give clear approval before the executive takes actions with “vast economic or political significance.”

Trump’s team quickly appealed. The administration has asked the Supreme Court (SCOTUS) to hear the case in early November 2025. For now, the ruling is paused until October 14.

The fight began when U.S. businesses and trade groups challenged the tariffs. They argued that Trump bypassed Congress and shifted the costs onto domestic firms. Studies suggest up to 86% of the burden fell on American companies and consumers.

Corporations from Nike to major automakers have already paid billions in disputed duties. By August 2025, businesses had transferred more than $210 billion under tariff programs courts now say were unlawful. Many importers are preparing refund claims, hoping SCOTUS will back them.

If the Supreme Court rules against Trump’s tariffs, the Treasury could owe $750 billion to $1 trillion in refunds. That would devastate government revenue and force Washington to borrow heavily.

Bond markets are already nervous. The 30-year Treasury yield briefly hit 5%, its highest since July. A ruling against the tariffs could spark more volatility in currencies, bonds, and equities.

For businesses and consumers, though, the news would be welcome. Lower import costs could reduce prices for everyday goods like clothing, electronics, and cars. But politically, such a verdict would undercut Trump’s tariff-first strategy and weaken his leverage in talks with trading partners.

If SCOTUS upholds the tariffs, the government’s cash flow stays strong. Bessent has projected that tariff collections could top $500 billion per year, making them one of Washington’s biggest revenue sources.

But this outcome has costs. American companies would remain squeezed, passing expenses to consumers and fueling inflation. Trade friction with partners would also deepen, leaving allies and rivals alike wary of Washington’s policies. For Trump, however, a win would strengthen his negotiating power abroad and prove that his hardline trade stance has legal backing.

The consequences stretch far beyond Washington.

In short, the Supreme Court’s decision is not just a domestic legal matter. It could reshape global trade rules and realign economic power balances.

Bessent has said he is confident the government will win in court. Yet his warning—that half of all tariffs might need to be refunded—shows how real the risks are.

If the U.S. Treasury Secretary himself admits that the outcome could be “terrible” for federal finances, it signals more than routine concern. It reflects the possibility of a fiscal shock, political embarrassment, and a major shift in trade policy.

Whether SCOTUS upholds or strikes down the tariffs, the decision will reshape U.S. economic strategy, test constitutional limits, and echo through global markets. And if Bessent sounds worried, it may be because the Treasury knows just how disruptive the truth could be.

Sign up for the Daily newsletter to get your biggest stories, handpicked for you each day.

Trending Now! in last 24hrs

Trending Now! in last 24hrs